We pave the way where there was none!

At flovver, innovation isn’t just a goal it’s how we stay ahead. Proactively evolving is key to providing our clients and partners with the best financing solutions. By combining cutting-edge technology with a deep understanding of our ecosystem, we’ve reached major milestones this year, reinforcing our commitment to making our products simpler, safer, and faster.

Here are some of our latest advancements, enhancing the customer experience and setting new industry standards:

1

Interac workflow

- Fully automated process, no manual intervention required

- Automatic transfer sent upon contract signing

- Instant deposit available 24/7

- Fast activation, same-day processing

2

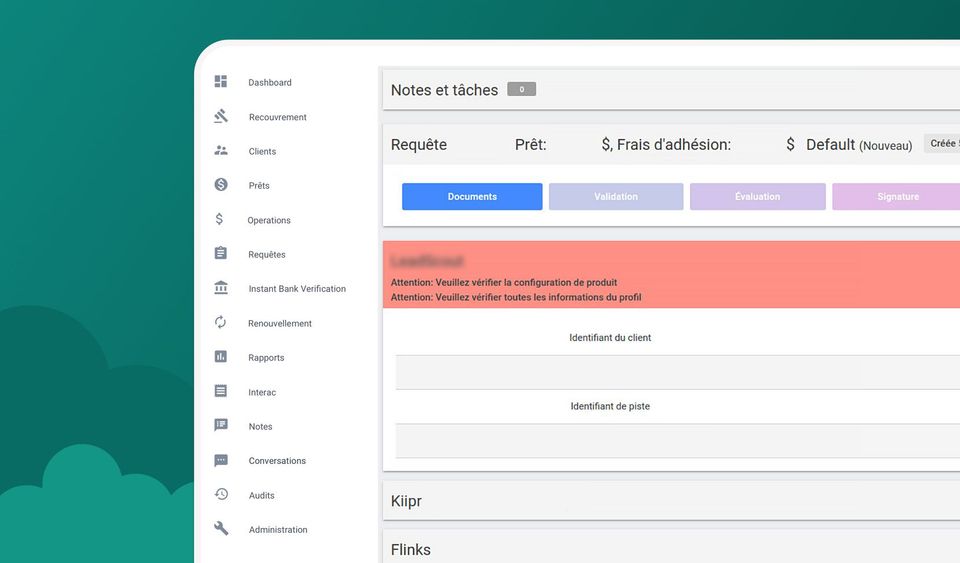

New finX UX/UI (in development)

- finX: New base layout featuring a side navigation menu and top bar

- Client Space & finX: Full separation and refactoring of user preferences code (account settings)

- Application form: Complete redesign and new code, combining renewals and new applications

- Authentication: Full refactoring and separation of the authentication module, with two-factor authentication implementation

- Client: Improved visual customization management for greater consistency

3

Enhanced security & compliance

- SOC II certification: obtained

- KPMG pentest successfully passed: a more secure platform than ever

4

Lead generator

- Generates qualified borrower leads

- Supports business growth

- Improves conversion of prospects into clients

5

Bank verification module

- IBV success rate significantly improved from 47% to 85%

- Reduced issues with certain banking institutions

- Enhances customer trust through seamless integration

- Optimized performance for continuous and smooth usage

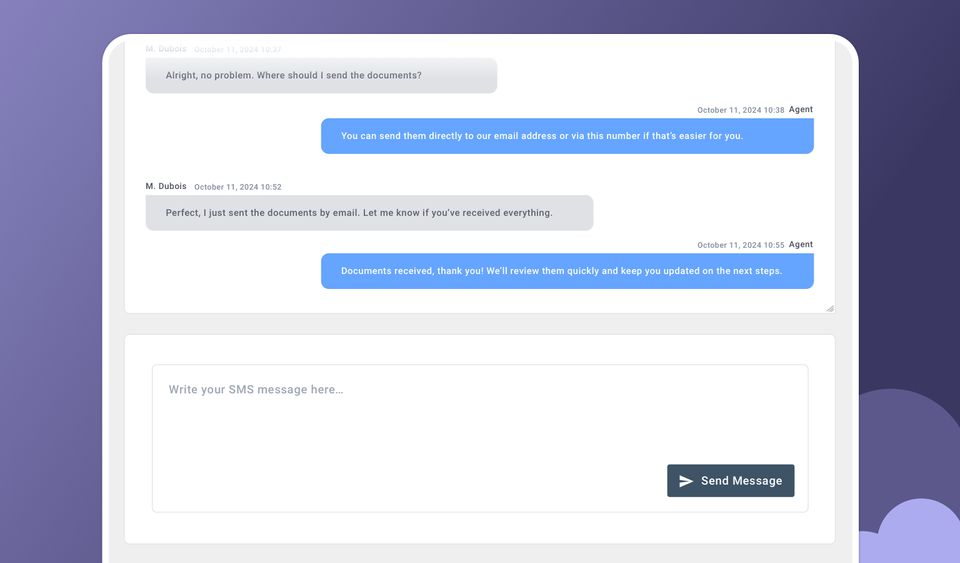

6

Conversation Module

- Real-time communication via SMS

- Enables teams to connect directly with clients

- Simplifies interactions for fast and efficient customer management

7

Support ticket system for the finX help center

- Optimized tracking with complete request traceability

- Centralized conversation history for better continuity

- Seamless connection between tasks and customer requests

- Faster, more efficient responses for an improved experience

8

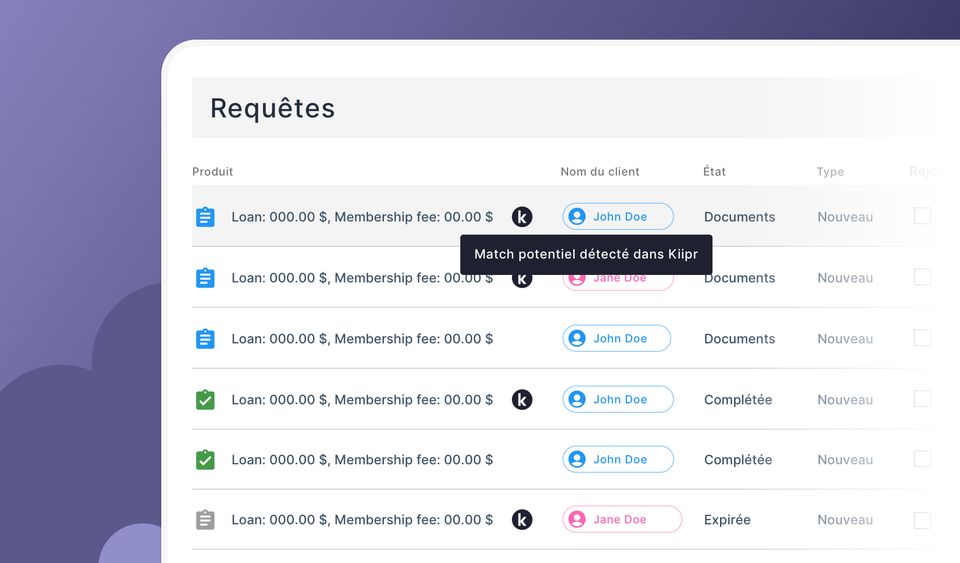

kiipr-match fonctionnality

- Instantly detects the presence of your clients within the kiipr ecosystem

- Optimizes efficiency by targeting users likely to generate valuable insights

9

Payment table updates

- Simplified payment processes

- Optimized for improved efficiency

- Expanded support for various loan types

10

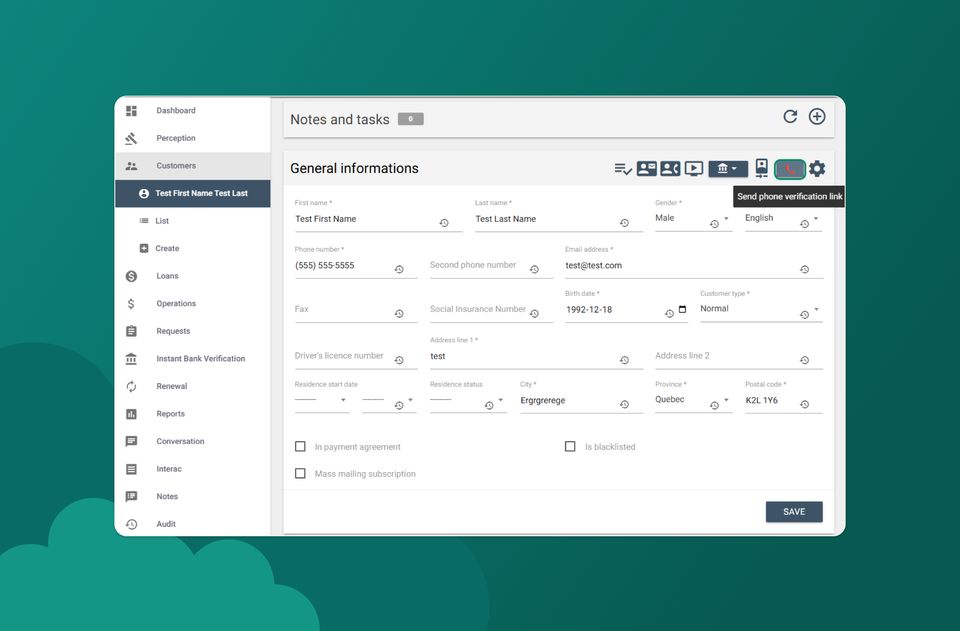

Identity & Phone verification

- Real-time verification

- Significantly reduces fraud risk

- Fully automated process

- Centralized identity tracking and management

11

Communication & update optimization

- Centralized distribution of announcements and updates

- Direct notifications and interactions

- Simplified access to the latest information.

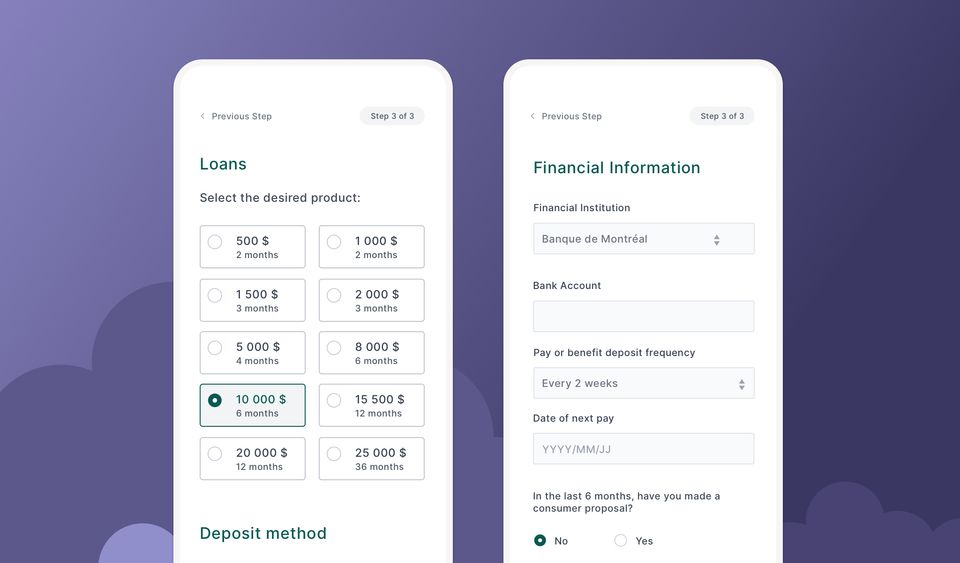

12

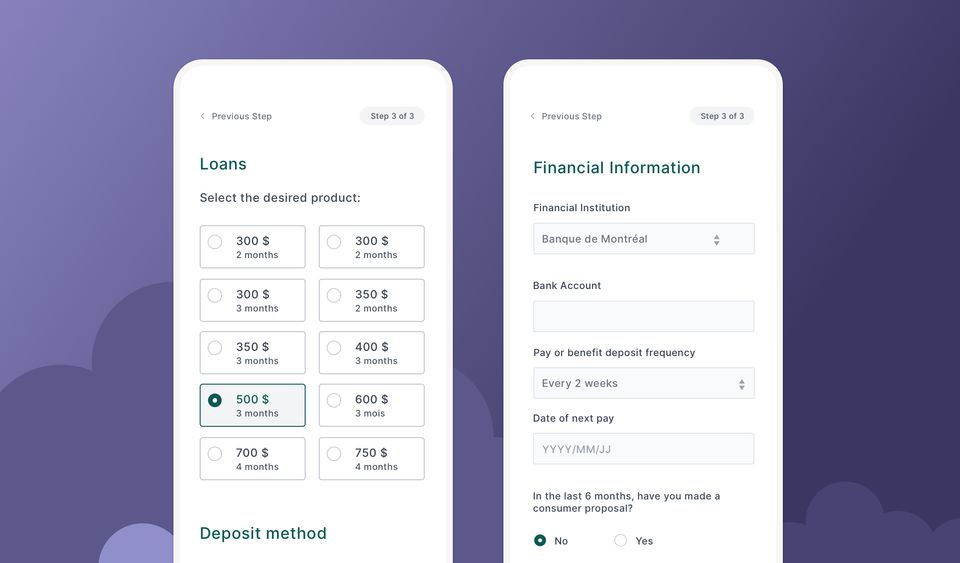

New form

- Simplified 3-step process

- Follow-up on abandoned requests

- Customizable interface

- Improved design and accessibility

- Automated completion & integrated renewal

13

New dedicated portal for flovver clients

- Initial client onboarding

- Instance setup: options and module selection

- Configuration of the company’s legal information

- Management of contacts and billing administrator per instance

14

New Websites

- kiipr: Daily connections activated with the credit bureau

- flovver: Strengthened online presence for optimal visibility