When technology and innovation address the limitations of traditional financing for growth-focused SMEs

Traditional financing methods, while essential, show their limitations when it comes to meeting the needs of innovative projects. They are not always accessible to all entrepreneurs, particularly those looking to fund bold ideas.

This is where alternative solutions come into play, such as flexible loans and crowdfunding. Platforms like Kickstarter, Indiegogo, and GoFundMe have democratized access to capital, allowing entrepreneurs to raise funds directly from the public. These tools offer greater flexibility and make fundraising simpler and more inclusive.

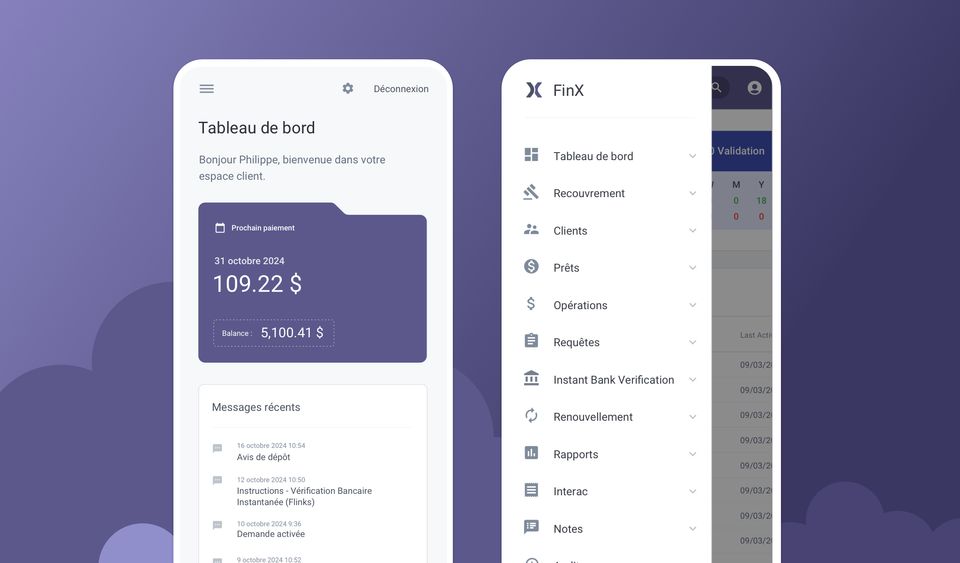

However, SMEs are also seeking solutions that give them better control over their finances. This is where loan self-management emerges: an approach that transforms traditional financing and opens up new opportunities for businesses.

Loan self-management: a flexible solution

To address the challenges of a demanding economic environment, SMEs are adopting digital tools that enable them to directly manage loans. This approach offers several key benefits:

Generate new revenue

By lending from their own funds, businesses can turn cash flow into growth opportunities.

Simplify processes

Automation reduces complex tasks, such as document analysis or automatic withdrawals.

Enhance client relationships

Providing flexible financing options helps retain customers and expand the client base.

Anticipate financial needs

Greater visibility into cash flow enables SMEs to plan ahead and avoid unexpected challenges.

Inspiring initiatives that support Canadian SMEs

La Ruche: mobilizing the community

As a nonprofit organization, La Ruche fosters the growth of Quebec regions through its crowdfunding platform. It enables entrepreneurs to raise funds from their community and bring innovative projects to life, contributing to local economic development.

PARI CNRC: Industrial research assistance program

The National Research Council of Canada’s Industrial Research Assistance Program (NRC IRAP) aims to accelerate the growth of small and medium-sized enterprises (SMEs) by providing them with a comprehensive range of innovation and funding services.

Microcrédit Montréal: An Inclusive and Social Impact Approach for SMEs

Through its Entrepreneurship Loan Fund, exclusively composed of social impact investments, Microcrédit Montréal supports SMEs and entrepreneurs excluded from traditional financing by offering tailored funding options while fostering a positive impact on the community.

Institutions (BMO, BDC, FPEC, Desjardins): financing for tech companies

Station Fintech Montréal: Supporting the growth of Quebec FinTechs

The Station Fintech Montréal offers young fintech companies a turnkey synergistic environment that fosters their development through three major programs: The Validation program provides free and personalized support to test and refine business models with target clients while granting access to the Station and its exclusive events. The Accelerator program, designed for companies in the growth phase, offers tailored support, a network of strategic partners, and funding opportunities to boost commercialization. Finally, the ElleFintech program helps women entrepreneurs develop a financing strategy, refine their pitching skills, and increase their visibility.

The Validation and Accelerator programs are accessible to both Quebec and Canadian fintechs.

Currently, over 35 fintechs benefit from the Station’s support.

Alternative solutions: Is it time to innovate?

SMEs today have a wealth of tools at their disposal to enhance financial management. From crowdfunding to loan self-management, these alternative solutions are reshaping the financial landscape. They democratize access to capital for bold, innovative projects and empower businesses to thrive in a constantly evolving marketplace.

Discover how these approaches can help you transform challenges into opportunities and position your company as a leader in the industry!