-

Automatic profile collection

-

Validation systems

-

IBV

-

Credit history

-

Evaluation reporting

-

eSignature

-

Amortization table

-

Payment collection

-

Deposit management

-

And more...

Launch without intermediaries

A trusted and reliable solution

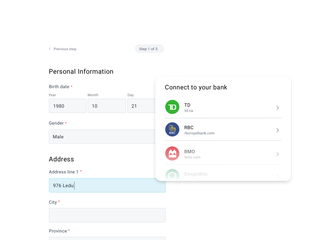

Application management

Access the most efficient loan application form on the market and track your borrowers’ requests every step of the way.

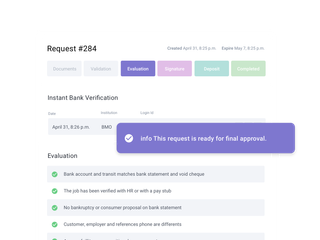

Evaluation and approval

Assess risk and process applications quickly with our evaluation modules, connected to major Canadian financial institutions.

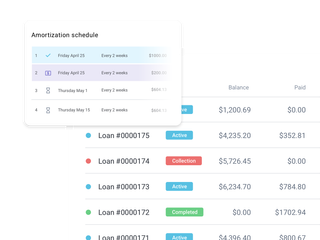

Loan management

Easily manage loan terms, payment and deposit schedules. Automate transactions and provide your clients with clear account statements.

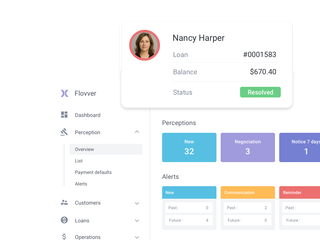

Perception management

Get detailed insights into your borrowers’ payment habits and receive alerts when issues arise. Automate account suspensions and simplify the management of at-risk files.

Reporting and analytics

Monitor the performance of your loans and operations in real time with reports tailored to your industry.

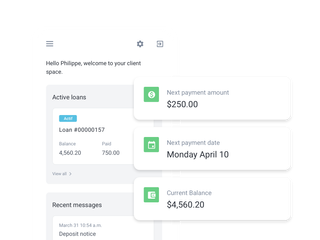

Client portal

Give your clients access to the status of their applications and loans in one place. Let them make online payments to repay their loans faster.

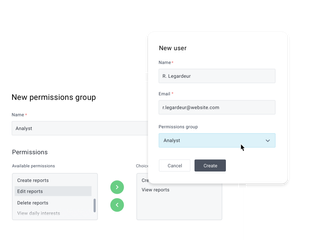

Roles and permissions

Grant granular access to your team to protect data security. Keep a full log of each user’s connections and actions.

Integrated communications

Communicate with clients via SMS or email. Automate your messaging and keep a history of all exchanges.

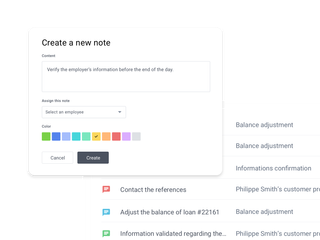

Tasks and notes

Create and assign tasks to team members. Add notes and comments to client profiles to support clear, consistent communication.

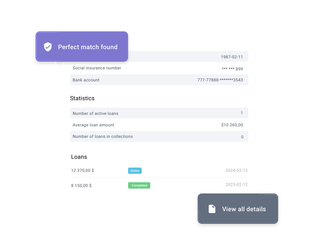

Credit bureau integration

Reduce risk with Kiipr, our integrated credit bureau, giving you detailed insights into your borrowers’ non-institutional loan history.

Strategic partnerships for maximum reach

Flexible to fit your needs